Average Return For A Balanced Portfolio . What is a balanced fund? 70% to 100% in stocks. what is the average return on a balanced portfolio? A balanced portfolio invests in both stocks and bonds to reduce potential volatility. Morningstar direct data as of jun 9, 2024. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. a return to form for 60/40 portfolios. Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. 40% to 60% in stocks.

from neofinancialpost.com

Morningstar direct data as of jun 9, 2024. A balanced portfolio invests in both stocks and bonds to reduce potential volatility. a return to form for 60/40 portfolios. 70% to 100% in stocks. Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. 40% to 60% in stocks. what is the average return on a balanced portfolio? from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. What is a balanced fund?

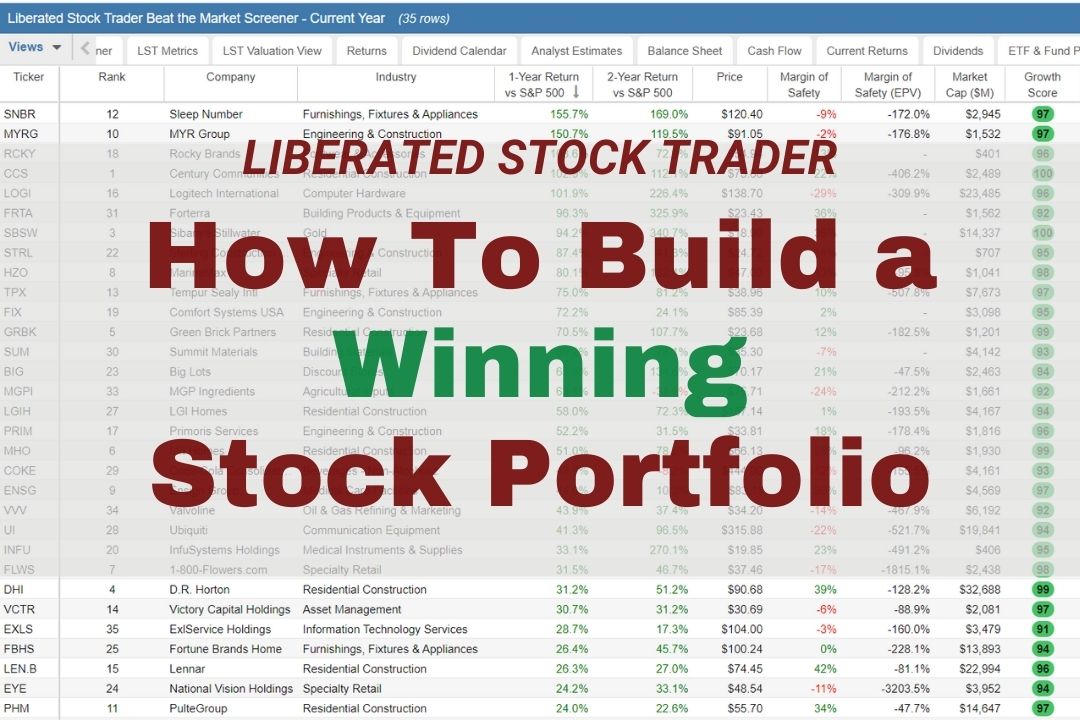

8 Steps to Build a Balanced & Profitable Portfolio Neo Financial Post

Average Return For A Balanced Portfolio A balanced portfolio invests in both stocks and bonds to reduce potential volatility. we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. a return to form for 60/40 portfolios. Morningstar direct data as of jun 9, 2024. Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. A balanced portfolio invests in both stocks and bonds to reduce potential volatility. 40% to 60% in stocks. What is a balanced fund? 70% to 100% in stocks. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. what is the average return on a balanced portfolio?

From exoncpuet.blob.core.windows.net

What Is In A Balanced Portfolio at Duane Basquez blog Average Return For A Balanced Portfolio 70% to 100% in stocks. 40% to 60% in stocks. Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. what is the average return on a balanced portfolio? A balanced portfolio invests in both stocks and bonds to reduce potential volatility. we look at the different methods for calculating your returns, the effect dividends. Average Return For A Balanced Portfolio.

From www.youtube.com

Balanced Portfolio How to Create a Balanced Investment Portfolio Average Return For A Balanced Portfolio What is a balanced fund? Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. A balanced portfolio invests in both stocks and bonds to reduce potential volatility. 40% to 60% in stocks. 70% to 100% in stocks. we look at the different methods for calculating your returns, the effect dividends and interest have on your. Average Return For A Balanced Portfolio.

From www.oldschoolvalue.com

How to Calculate Your Time Weighted Return Portfolio Performance Average Return For A Balanced Portfolio 40% to 60% in stocks. what is the average return on a balanced portfolio? Morningstar direct data as of jun 9, 2024. 70% to 100% in stocks. A balanced portfolio invests in both stocks and bonds to reduce potential volatility. we look at the different methods for calculating your returns, the effect dividends and interest have on your. Average Return For A Balanced Portfolio.

From smartasset.com

How to Calculate the Beta of a Portfolio Formula and Examples Average Return For A Balanced Portfolio Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. a return to form for 60/40 portfolios. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. 40% to 60% in stocks. What is a balanced fund? 70% to. Average Return For A Balanced Portfolio.

From www.awesomefintech.com

Portfolio Return AwesomeFinTech Blog Average Return For A Balanced Portfolio a return to form for 60/40 portfolios. we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. what is the average return on a balanced portfolio? 40% to 60% in stocks. . Average Return For A Balanced Portfolio.

From www.financestrategists.com

Modern Portfolio Theory (MPT) Definition & How It Works Average Return For A Balanced Portfolio What is a balanced fund? 40% to 60% in stocks. we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a.. Average Return For A Balanced Portfolio.

From successfulportfolios.com

Learn How to Calculate the Rate of Return on Your Investment Portfolio Average Return For A Balanced Portfolio from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. 70% to 100% in stocks. what is the average return on a balanced portfolio? A balanced portfolio invests in both stocks and bonds to reduce potential volatility. Morningstar direct data as of. Average Return For A Balanced Portfolio.

From ulinwealth.com

R.I.P. 60/40? Balanced Portfolios are Alive and Well Boca Raton FL Average Return For A Balanced Portfolio we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. 70% to 100% in stocks. A balanced portfolio invests in both stocks and bonds to reduce potential volatility. What is a balanced fund? Morningstar direct data as of jun 9, 2024. from 1972 to 2021 a. Average Return For A Balanced Portfolio.

From www.financestrategists.com

Expected Return (ER) Of a Portfolio Calculation and Limitations Average Return For A Balanced Portfolio we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. what is the average return on a balanced portfolio? What is a balanced fund? 70% to 100% in stocks. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and. Average Return For A Balanced Portfolio.

From exopsrxtr.blob.core.windows.net

Average Return In Portfolio at Kathy Hall blog Average Return For A Balanced Portfolio A balanced portfolio invests in both stocks and bonds to reduce potential volatility. what is the average return on a balanced portfolio? we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. 70% to 100% in stocks. a return to form for 60/40 portfolios. Morningstar. Average Return For A Balanced Portfolio.

From exopsrxtr.blob.core.windows.net

Average Return In Portfolio at Kathy Hall blog Average Return For A Balanced Portfolio Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. Morningstar direct data as of jun 9, 2024. what is the average return on a balanced portfolio? What is a balanced fund? A balanced portfolio invests in both stocks and bonds to reduce potential volatility. from 1972 to 2021 a 60/40 portfolio consisting of an. Average Return For A Balanced Portfolio.

From realinvestmentadvice.com

A Balanced Portfolio Promises a Better 2023 RIA Average Return For A Balanced Portfolio What is a balanced fund? what is the average return on a balanced portfolio? a return to form for 60/40 portfolios. Morningstar direct data as of jun 9, 2024. Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. 40% to 60% in stocks. A balanced portfolio invests in both stocks and bonds to reduce. Average Return For A Balanced Portfolio.

From www.fidelity.com

What Is Portfolio Diversification? Fidelity Average Return For A Balanced Portfolio 70% to 100% in stocks. 40% to 60% in stocks. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. we look at the different methods for calculating your. Average Return For A Balanced Portfolio.

From breakingthemarket.com

How to Balance a Portfolio Average Return For A Balanced Portfolio from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. A balanced portfolio invests in both stocks and bonds to. Average Return For A Balanced Portfolio.

From seekingalpha.com

The Merits Of A Balanced 60/40 Portfolio In The 2020s (NYSEARCAAGG Average Return For A Balanced Portfolio 40% to 60% in stocks. we look at the different methods for calculating your returns, the effect dividends and interest have on your overall portfolio, and the. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. What is a balanced fund?. Average Return For A Balanced Portfolio.

From www.numerade.com

SOLVED The historical returns on a balanced portfolio have had an Average Return For A Balanced Portfolio 70% to 100% in stocks. what is the average return on a balanced portfolio? Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. A balanced portfolio invests in both stocks and bonds to reduce potential volatility. we look at the different methods for calculating your returns, the effect dividends and interest have on your. Average Return For A Balanced Portfolio.

From www.fidelity.com.sg

How a wellbalanced portfolio can prepare you for volatility Fidelity Average Return For A Balanced Portfolio Statistics compiled by financialsamurai.com show the following rates of return, consistent with other. Morningstar direct data as of jun 9, 2024. a return to form for 60/40 portfolios. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. we look at. Average Return For A Balanced Portfolio.

From www.fergusonwellman.com

Sample Balanced Portfolio — Ferguson Wellman Average Return For A Balanced Portfolio 70% to 100% in stocks. from 1972 to 2021 a 60/40 portfolio consisting of an s&p 500 index for stocks and intermediate term treasuries for bonds has returned 9.61% with a. A balanced portfolio invests in both stocks and bonds to reduce potential volatility. what is the average return on a balanced portfolio? we look at the. Average Return For A Balanced Portfolio.